does nevada tax your retirement

The median home sale price there was 315000 as of May 2020 according to Las. New Jersey doesnt tax Social Security benefits but may tax other forms of retirement income.

To find a financial advisor who serves your area try our free online matching tool.

. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. Tax Strategies for Your Retirement Income. Either 75 or 10000 of your retirement pay is.

Please remember to contact Bogart Wealth in writing if there are any changes in your personalfinancial situation or investment objectives for the purpose of reviewingevaluatingrevising our previous recommendations andor services or if you would like to impose add or to modify any reasonable restrictions to our investment advisory services. Arizonas property taxes are relatively low but sales taxes are fairly high. While California exempts Social Security retirement benefits from taxation all other forms of retirement income are subject to the states income tax rates which range from 1 to 133.

Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming. PERS-Public Employees Retirement System of Nevada The Public Employees Retirement System of Nevada PERS is a tax-qualified defined benefit plan created by the Legislature as an independent public agency to provide a reasonable base income to qualified employees who have been employed by a public employer and whose earning capacity has been removed or has. The state of Alabama doesnt tax Social Security benefitsTraditional pension payments are also excluded from taxable state income including private defined benefit plan payments and retirement.

Eight states have no income taxes. Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. Up to 2000 of retirement income.

As we continue to look at tax types that can harm states post-coronavirus recovery its worth highlighting taxes on business inventory. Up to 3500 is exempt Colorado. In addition to taxes on the value of buildings and land businesses can also pay property.

20000 for those ages 55 to 64. The state does however tax other types of retirement income like distributions from an IRA or a 401k. New Hampshire doesnt tax wages but does tax dividends and interest.

Up to 24000 of military retirement pay is exempt for retirees age 65 and older. Beginning in the 2021 tax year the New Jersey Retirement Income Exclusion is available to retirees earning less than 150000 per year. Inventory taxes fall under the umbrella of the property tax which is the largest tax paid by businesses at the state and local levels.

You cant take the exclusion if you take a part-time job unless you earn under 3000. Southern Nevada including Greater Las Vegas typically draws tourists for its gaming and entertainment industry. Military retirement pay is partially taxed in.

And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Additionally California has some of the highest sales taxes in the US. 10 Ways to Reduce Your.

Arizona does not tax Social Security retirement benefits.

Nevada Retirement Tax Friendliness Smartasset

State By State Guide To Taxes On Retirees Kiplinger Retirement Retirement Advice Tax

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

States Without Income Tax Income Tax Inheritance Tax Income Tax Brackets

37 States That Don T Tax Social Security Benefits The Motley Fool

States That Don T Tax Retirement Income Personal Capital

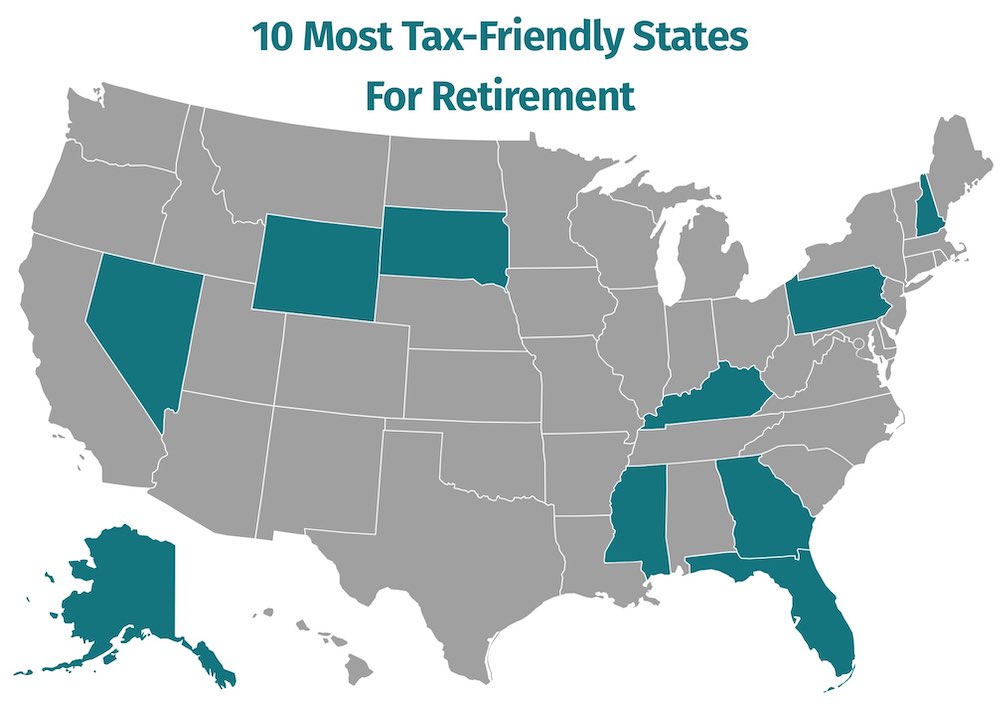

Tax Friendly States For Retirees Best Places To Pay The Least

The 10 Best Places To Retire In Nevada Newhomesource Best Places To Retire Nevada Places

State By State Guide To Taxes On Retirees Retirement Tax Retirement Income

Kiplinger Tax Map Retirement Tax Income Tax

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

A Guide To The Best And Worst States To Retire In

10 States That Attract The Most Retirees Voting With Their Feet Best Places To Move Best Places To Retire Retirement

13 Places Everyone Will Be Flocking To For Retirement In The 2020s Washington Hikes Low Taxes Living In Colorado

7 States That Do Not Tax Retirement Income

Top 10 Most Tax Friendly States For Retirement 2021

Nevada Retirement Tax Friendliness Smartasset

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map